California State Tax Bracket 2024

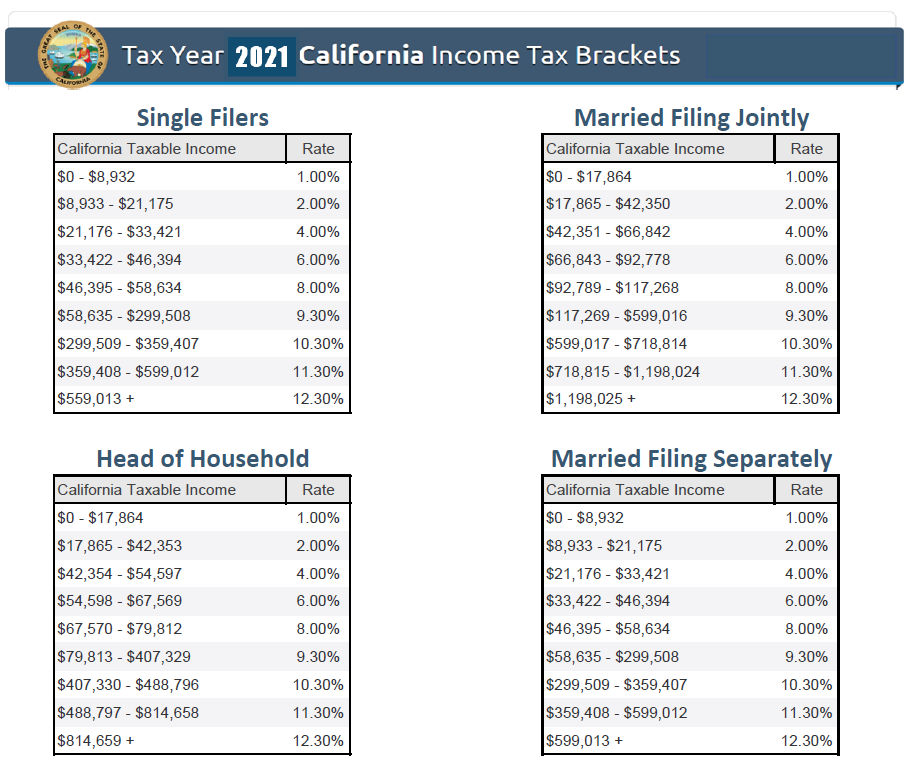

California State Tax Bracket 2024. 1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3%, and 12.3%. 4% on taxable income between $20,256 and.

The annual salary calculator is updated with the latest income tax rates in california for 2024 and is a great calculator for working out your income tax and salary after tax based. This page has the latest california brackets and tax rates, plus a california income tax calculator.

2% On Taxable Income Between $8,545 And $20,255.

1%, 2%, 4%, 6%, 8%, 9.3%, 10.3%, 11.3%, and 12.3%.

First, We Calculate Your Adjusted Gross Income (Agi) By Taking Your Total Household Income And Reducing It By Certain Items Such As Contributions To Your 401 (K).

The deadline to file a california state tax return is april 15, 2024, which is also the deadline for federal.

What The Irs Adjusting 2024 Tax Brackets For Inflation Means For You | Dollars And Sense.

Images References :

Source: antoniewelset.pages.dev

Source: antoniewelset.pages.dev

Tax Rate In California 2024 Blisse Zorana, The top california income tax rate has been 13.3% for a decade, but. The income tax rates and personal allowances in california are updated annually with new tax tables published for resident and non.

Source: dorisachloris.pages.dev

Source: dorisachloris.pages.dev

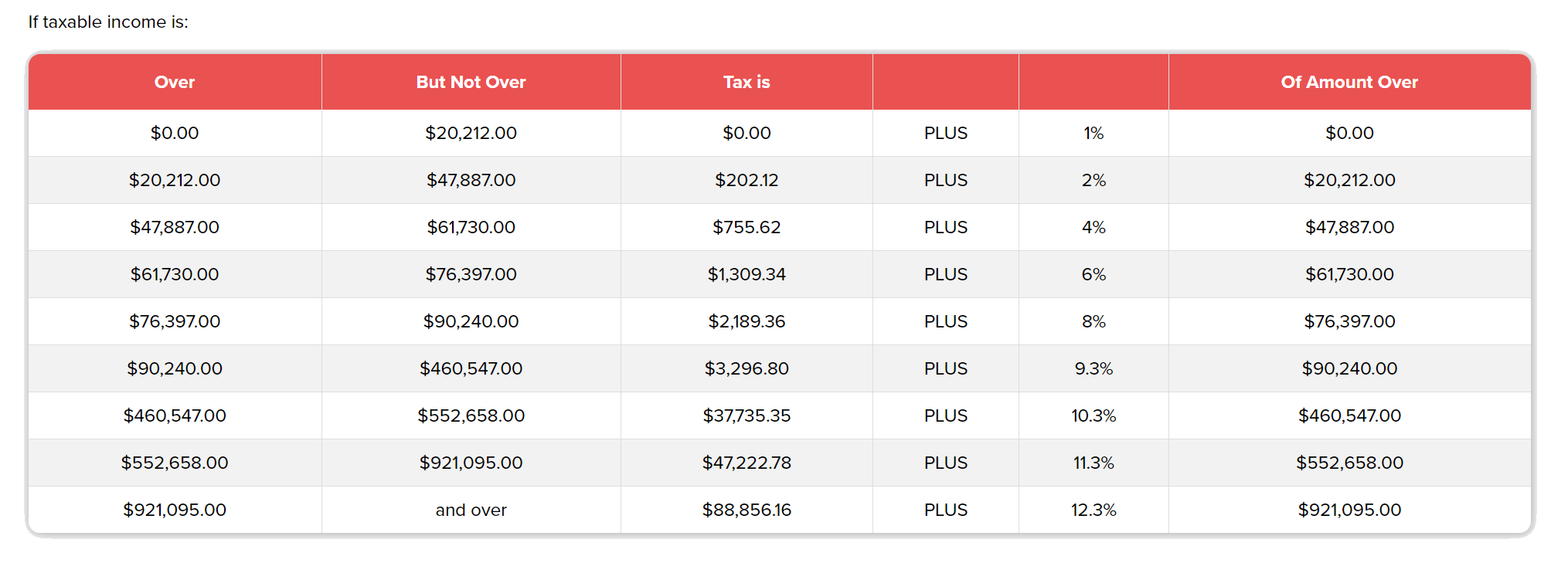

Federal Tax Due Date 2024 For California Residents Judye Marcile, The tax for a single filer with $110,000 in taxable income and no dependents is $6,882 in california,. What is the deadline for filing california state taxes in 2024?

Source: neswblogs.com

Source: neswblogs.com

2022 California State Tax Brackets Latest News Update, Pit receipts expected in april represent 7.67 percent of total general. If you are thinking about moving, you might compare income taxes.

Source: federal-withholding-tables.net

Source: federal-withholding-tables.net

California State Tax Table 2021 Federal Withholding Tables 2021, This calculator does not figure tax for form 540 2ez. (california also imposes a 1.1 percent payroll tax a payroll tax.

Source: tomaqcandide.pages.dev

Source: tomaqcandide.pages.dev

Tax Calculator By State 2024 Ania Meridel, What is the deadline for filing california state taxes in 2024? The tax for a single filer with $110,000 in taxable income and no dependents is $6,882 in california,.

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

10+ 2023 California Tax Brackets References 2023 BGH, Californians pay the highest marginal state income tax rate in the country — 13.3%, according to tax foundation data. This page has the latest california brackets and tax rates, plus a california income tax calculator.

Source: www.moneydigest.com

Source: www.moneydigest.com

These Are The California State Tax Rates And Tax Brackets For 20232024, This page has the latest california brackets and tax rates, plus a california income tax calculator. If you are thinking about moving, you might compare income taxes.

Source: maxinewmoyna.pages.dev

Source: maxinewmoyna.pages.dev

California Supplemental Tax Rate 2024 Ree Lenora, Calculate your tax using our calculator or look it up in a table of rates. Marginal tax rate 22% effective tax rate 10.94% federal income tax $7,660.

Source: www.pdffiller.com

Source: www.pdffiller.com

20222024 Form CA FTB Tax Table Fill Online, Printable, Fillable, Blank, The annual salary calculator is updated with the latest income tax rates in california for 2024 and is a great calculator for working out your income tax and salary after tax based. The tax rates and tax brackets below apply to income earned in 2023 (reported on 2024 returns).

Source: www.westerncpe.com

Source: www.westerncpe.com

Know Your California Tax Brackets Western CPE, 2% on taxable income between $8,545 and $20,255. The california income tax has nine tax brackets.

This Calculator Does Not Figure Tax For Form 540 2Ez.

If you’re wondering what your top 2024 california and federal taxes rates are, look no further.

* Required Field California Taxable Income Enter Line 19 Of 2023 Form 540 Or Form 540Nr.

If you are thinking about moving, you might compare income taxes.